Fueling Entrepreneurs

Early Growth Equity | B2B Software & AI

We back founders building B2B and vertical software that uses AI to solve real, industry-specific problems.

Investment Focus

Stage

- Proven product-market fit

- $2-10 million recurring revenue

- Strong & efficient growth

- Reasonable cash burn

Sectors

- Healthcare IT

- Supply Chain & Industrial

- FinTech

- AI for Enterprise

Structure

- $5-15 million deal size

- Lead or co-lead

- Reserve capital for follow-on

- Target 3-7 year exit time frame

Geography

- Headquartered in U.S.

- Core focus on Mid-western, Eastern, and Southern metros

Our Value Proposition

What sets us apart.

Aligned Approach

Stage-appropriate capitalization, efficient growth to minimize founder dilution, multiple paths to a win-win outcome.

Quality Over Quantity

We do fewer deals per fund so we can commit both our time and our capital to each partner.

Expert Support System

We help assemble the 'team behind the team' to support founders, facilitate introductions and accelerate value creation.

Experienced Operators

Significant early growth experience on both sides of the table enables us to advise on a wide range of scaling challenges.

Vocap Insights

Notes from the field on building durable, efficient growth companies.

There is a better way

We aren’t fans of some key trends in early-stage investing. Funds have ballooned in size and investors are doing many more deals per fund. This over-extends investors and undermines their ability to provide meaningful support to founders. It also feeds a “ unicorn or bust" imperative, prioritizing the fund’s economics over the company’s needs.

If you have found yourself changing your financial projections or the amount of your fundraise to fit what investors want to hear, or if you have wondered where your "value add" investors went after the deal is closed, then you know what we are talking about.

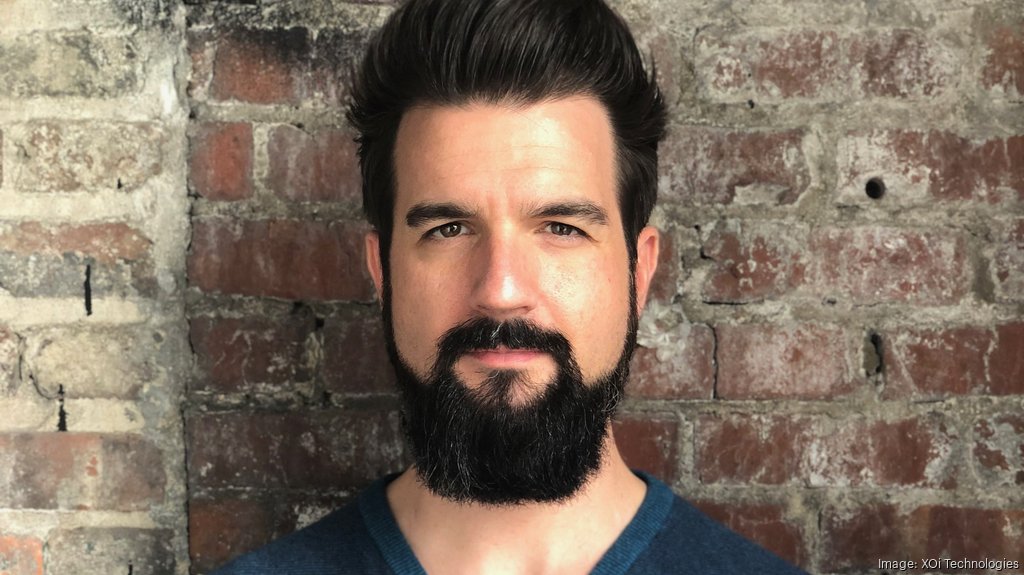

Testimonials

What our portfolio company CEOs have to say about working with Vocap.

The World is Shifting Up a Gear

The pace of innovation in AI, cloud, modalities, and interoperability is accelerating exponentially.

Entrepreneurs leveraging this innovation to address genuine industry challenges, cutting through the hype to deliver tangible results.

Capital and know-how to keep the tires on the track of efficient growth and drive great outcomes for all involved.